- 9810093505

- cwsi2007@gmail.com

-

Call Us

9891646004

-

Email Us

thechildwelfaresociety@gmail.com

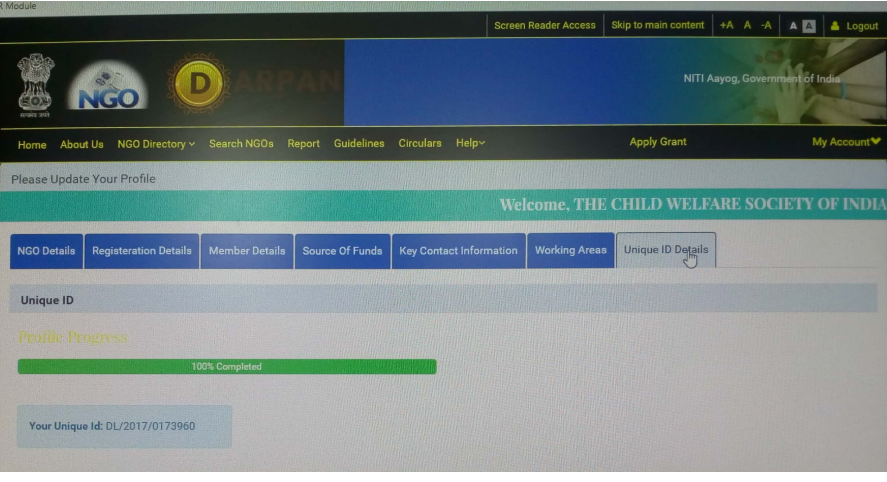

- Niti Ayog : DL/2017/0173960.

- Society Registration No. : S/31973

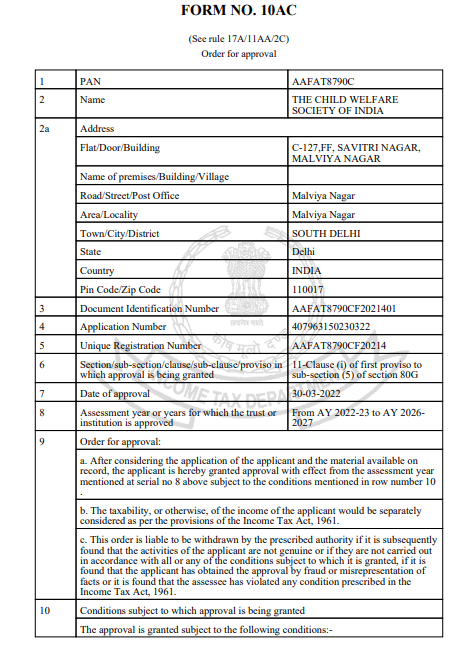

- 80G Registration No. : AAFAT8790CF20214

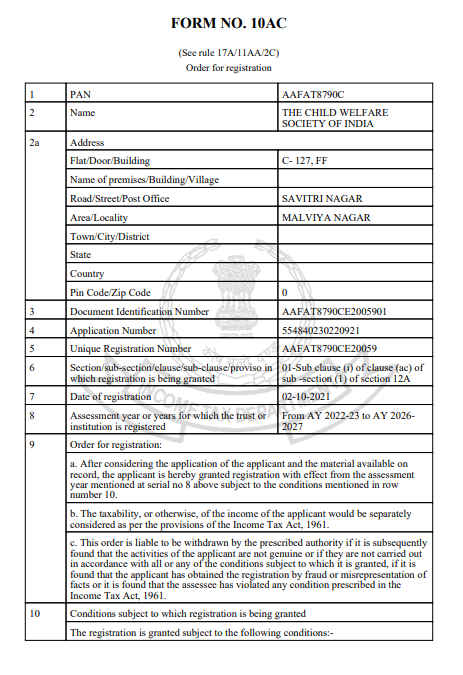

- 12A Registration No. : AAFAT8790CE2005901

9891646004

thechildwelfaresociety@gmail.com

The Child Welfare Society India has been formed by the people from all over India as legally constituted non-profit making organization, voluntary with the Registrar of the Societies, at NCT of Delhi under the Societies Registration Act XXI of 1860 (Registration No. S/31973 dated 24.9.1997).

All donations received by the Society from general public are exempted under Income Tax Act and issue the rebate certificate of income tax under section 80G of Income Tax Act 1961 vide order No. under section 11 Clause (I) of first proviso to sub – section (5) of section 80G vide URN no. AAFAT8790CF20214 Dt. 30.3.2022 from A.Y. 2022-23 to A.Y. 2026-2027.

The CWSI is registered u/s 12A read with section 12AA/12AA (1) (b) of the Income Tax Act 1961 vide 0.0. по. (Е) 97-98/Т-494/98/342 date 28.01.1998, 12A Registration No. of the society is AAFAT8790CE2005901

The Permanent Account Number of the society is AAFAT8790C. Under which filling of Income Tax Return is mandatory.

The Government of India has made it mandatory to all Societies / NGO’s to register with NITI AAYOG to get donation/ grant/CSR. The Child Welfare Society of India is also abide by this and registered with NITI AYOG vide UNIQUE ID: DL/2017/0173960.

Copyright © 2025-26 The Child Welfare Society Of India. All Rights Reserved.

WhatsApp us